Can China Rebuild its Legacy or is it Blocked by Trump's Lunacy?

After the pandemic, China has been struggling economically. China’s economic struggles have led to a drop in consumer prices. This deflation does not come without consequences for the rest of the world; weak consumer spending in China means that Chinese producers need to export their goods overseas in order to find buyers, making exporting prices cheaper too. These cheaper prices are putting pressure on producers from the rest of the world. It is therefore perhaps not crazy that Trump is endorsing downgrading China’s trade status with the U.S. if he gets reelected in June 2024. The GOP front-runner wants to achieve this by raising China tariffs to possibly 60 percent. However, Adam Posen, president of the Peterson Institute of International Economics, has called Trump’s plans ‘lunacy’ and argued that this trade war would affect U.S. firms by depriving billions of potential customers. But why did the Chinese economy struggle after the pandemic? And is Trump right by increasing the China tariffs or is it indeed ‘lunacy’?’

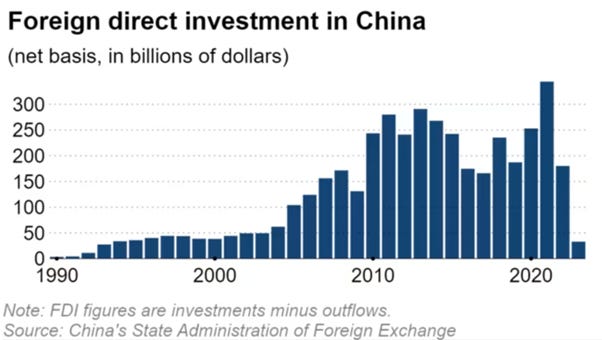

To begin with, foreign investments have not been so low in China for 30 years. An 80% decline in foreign investment in 2023 compared to 2022 is softly said not a small nudge. This decrease in foreign investment is, among other things like the rising geopolitical tensions with the West, caused by China’s anti-espionage law which was implemented in July 2023. To guard national secrets, China’s anti-espionage law has the power to potentially shut down companies for mishandling data or technology. Companies are delaying and some are even abandoning planned investments in China due to fear and unintended legal entanglements particularly when working with sensitive data and new technologies.

Recently, the Chinese economy has also taken a hit in domestic investment. This is mainly due to the collapse of the real estate company Evergrande. A judge in Hong Kong has ruled that Evergrande must sell all its assets to repay its creditors. People who have bought a house, paid in advance and with the liquidation of Evergrande, some of these houses will never be built. This reduces the trust of the Chinese population and investors in the Chinese housing market, which has a negative effect on the house prices, i.e. the house prices will decrease. With this decrease in house prices, the collateral of the Chinese house owners decreases as well.

By the financial accelerator mechanism, this decrease in house prices leads to an even more deteriorating economy. Due to these lower house prices, the financial health of households gets weaker. As a result of the weaker balance sheets, consumption decreases and the interest rates of lenders increase. Thus, a downward spiral emerges, only amplifying the effect of the initial collapse of Evergrande.

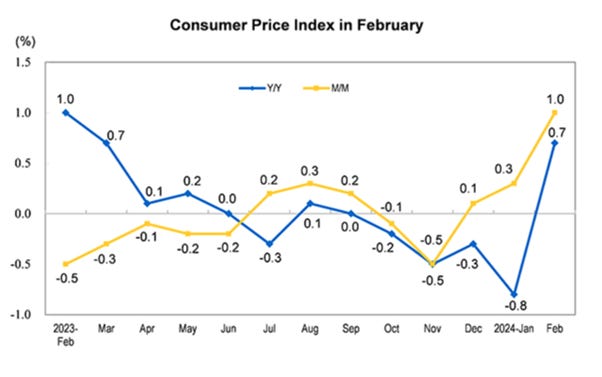

It is not only the housing crisis and a low in foreign investment, there is also a lack in demand, which is probably caused by the economic events mentioned earlier. Although credible figures are missing, there are many clues that Chinese wages have been cut. This lack in demand can also be seen in China’s consumer price index (CPI):

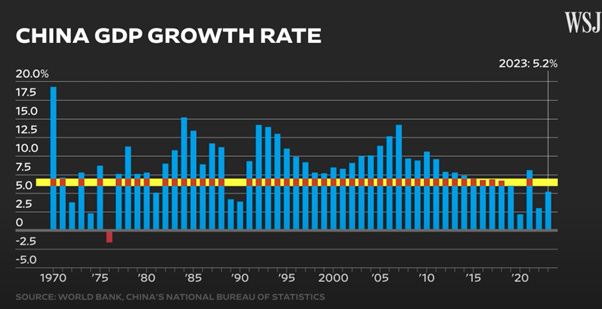

Although in February 2024 there was a big rise in the CPI, China coped with a few months of deflation. Deflation can be really dangerous for an economy since consumption is generally delayed which causes more deflation. At the moment China's population shows signs of weak consumer spending, which is in harmony with the CPI. The amount of deflation can be uncertain, as one can see in the graph of the National Bureau of Statistics, but there is no denying that China is in a period of slow growth as can be seen in the following graph.

Yet, it is still the question if these numbers presented in the graph by the National Bureau of Statistics of China are even correct. Multiple economists are doubting the legitimacy of these statistics since most growth numbers have been rather exaggerated according to Western economists who calculated the GDP themselves.

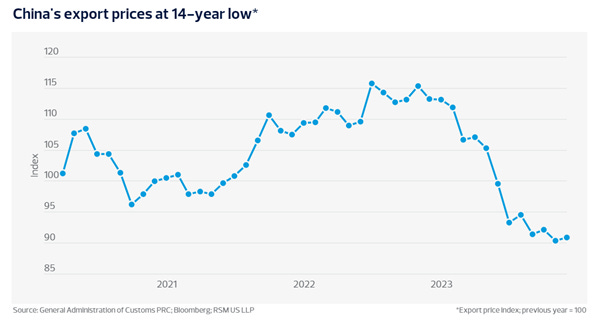

Since China’s economy is in such a low state, the Chinese economy is desperate to improve. One of their main ideas to make this change is growing even more in export. To do this, one of their main strategies is lowering export prices. These prices have been declining since June 2023 and are at their lowest point in 14 years. With these lowering export prices, China hopes to increase demand from foreign countries, to fuel their economy.

Now an interesting question arises, how can China lower export prices? Firms aim to make a profit from their businesses and aim for a profit-maximizing markup, which can be obtained by setting the right price. One could imagine that a possible mandatory price reduction from the Chinese government would not be something that the firms would accept without resistance. Therefore the Chinese government provides subsidies to the exporting firms. With those export-supporting subsidies, the firms are able to sell their products for a lower price to the global market.

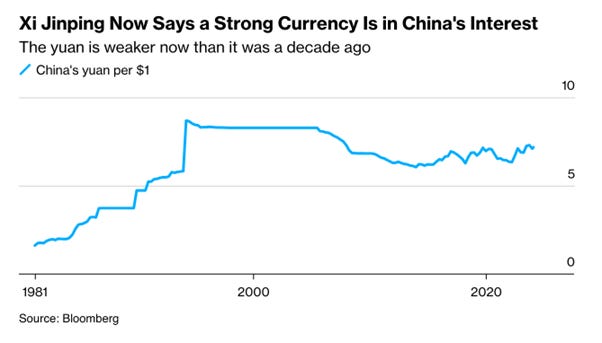

Another factor that can play a role in lower export prices, is by keeping a currency undervalued. Looking back to 2018, when the first China tariffs were introduced, the Trump administration accused China of artificially undervaluing its currency. A lower value of the Yuan relative to other currencies is beneficial for international consumers and Chinese exporters since it is cheaper to produce and buy goods. While one of the losers of an undervalued currency is U.S. multinationals; since sales are hurt as a result of an undervalued currency. Hence, the U.S. economy is undermined by the undervaluing of the Yuan since multinationals have fewer customers and U.S. producers have fewer customers too.

The Yuan's current exchange rate is, as one can see in the graph, currently low, which could be argued that it is undervalued. However, Xi stated in the People’s Congress that wants to be a global financial power. To reach this goal, a strong currency is needed. So it looks like that this lower Yuan is currently not in China’s Interest. But we have to keep in mind that nothing is like what it seems that China presents to the outer world.

Nevertheless, China’s lower export prices are real and not without consequences. Other countries, like the U.S., may perceive these low export prices as a threat. The low export prices from China could be a risk for businesses in the importing country because they can not compete with the prices of products from China. In the short term, this might seem beneficial for the importing country, since the import prices are lower. Yet, it leads to the loss of domestic industries, which results in higher unemployment and fewer incentives for innovation, causing bad economic consequences in the long term. This is a situation all countries would like to avoid.

In response to this threat, countries may introduce protectionist policies to protect their own economy. This is exactly what Trump did in 2018 by raising the China tariffs. Furthermore, Biden was planning to introduce tariffs on food-can metal from China and other countries, and Biden was exploring raising tariffs on China’s EVs to protect their own economy. That’s why Trump wants to raise the tariffs if he gets reelected; he wants to protect the economy of the U.S..

These potential protectionist policies, when used, would have a counterproductive effect on the outcome China had hoped for. As a result of these protectionist policies the net exports decrease which results in again less output. Right now there are no countries that use the protectionist policy but when they do this could lead to an even bigger economic downturn for China.

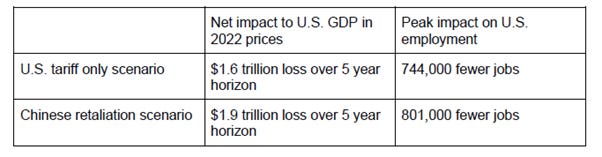

These policies could also have catastrophic consequences for the U.S. After all, the U.S. has reaped substantial benefits from increased trade with China since China’s Permanent Normal Trade Relations (PNTR), i.e. China’s membership in the World Trade Organisation (WTO). As a result of the increased tariffs in 2018, a decrease in output and jobs emerged in the U.S.. In November 2023 Oxford Economics researched the consequences of the escalation of existing tariff measures in the form of revoking China’s PNTR status. In this study, the scenario is modeled in which only the U.S. increases the tariffs. Another scenario that is modeled in this study is that the U.S. increases the tariffs in combination with Chinese policy retaliation, which means that China raises tariffs for the U.S. as well. This second case is, based on policy moves of the last five years, highly likely to happen.

Thus, the poor state of China's economy evokes quite a few reactions. While China just seems desperate to improve, individuals like Trump still seem skeptical of China’s true intentions. After all, there is undoubtedly more unfolding behind the scenes in China than meets the eye. And indeed, China’s low export prices could form a threat to the U.S. economy, but Trump's plan to engage in a trade war is all the more dangerous.